| Author: | Konstantin Rybakov |

| Publication Date: | First publication date: March 2018 Last update: March 2018 |

| Notes: | pdf:

CMO_pricing_notes.pdf docx: CMO_pricing_notes.docx |

| Excel tools: | Excel tool:

cmo.xlsm pdf screen: cmo.pdf |

| Objective: | The tool constructs the tranche structure of the collateralized mortgage obligations series and performes valuation of each individual tranche using both NPV and Monte Carlo simulations approches. |

A collateralized mortgage obligation (CMO) is a type of complex debt security that repackages and directs the payments of principal and interest from a collateral pool of mortgage loans to different types of securities. Legally, a CMO is a debt security issued by a special purpose entity (SPE) (thus it is not considered a debt owed by the institution creating and operating the SPE). The SPE is the legal owner of a set of mortgages, called a pool. Investors in a CMO buy bonds issued by the entity, and they receive payments from the income generated by the mortgages according to a defined set of rules. With regard to terminology, the mortgages themselves are termed collateral, 'classes' refers to groups of mortgages issued to borrowers of roughly similar credit worthiness, tranches are specified fractions or slices, metaphorically speaking, of a pool of mortgages and the income they produce that are combined into an individual security, while the structure is the set of rules that dictates how the income received from the collateral will be distributed. The legal entity, collateral, and structure are collectively referred to as the deal. Unlike traditional mortgage pass-through securities, CMOs feature different payment streams and risks, depending on investor preferences.

CMO securities offer the following advantages.

- An average mortgage loan amount (say US$ 300,000) is quite material for an average investor. Issue of bonds collateralized by mortgage loans allows to set flexible principal amount on each bond. For example a US$ 300,000 mortgage loan can be split into 300 bonds with US 1,000 principal amount.

- Mortgage loans are long-term (they typically have a 30-year maturity term). Investors typically prefer not to lock their funds on such a long period. CMO instruments are traded publicly and therefore allow investors to sell the bonds at any time.

- Securities issued in a CMO deal typically have a flexible structure so that investors with different risk / return preferences can buy the securities.

- Default risk s diversified in a pool of mortgage loans. Traditionally the CMO securities were viewed as having very good creditworthiness. However the market crash in 2008-2009 showed that defaults in a mortgage loan pool can be strongly correlated and collateral value of the houses can decrease significantly during the crisis. The credit rating on many CMO securities was downgraded from AA to CCC within a few month period during the market crash. Therefore potentially investment into CMO securities can be highly risky.

The major risks associated with the CMO securities are the following:

- Default risk. House buyers default on their mortgages. After the default, the houses go into foreclosure and may often be sold at the price that is lower than the mortgage loan outstanding principal balances.

- Prepayment (refinancing) risk. Mortgage loans are amortized over the 30-year maturity term. Moreover the loans can be prepaid without penalty partially or in whole at any time. The mortgage loans are often prepaid when the mortgage market rates go down so that the mortgage can be refinanced at a lower rate. The risk is called the interest rate risk (or refinancing risk). Effectively the investment horizon in the CMO securities is less than 30-years. The prepayment risk must be reflected as the yield premium or price discount of the CMO security.

To address the above risks, the CMO deal structure specifies loss and principal allocation rules so that different securities within the CMO deal are protected differently against the default and prepayment risks.

Loss Allocation Rules

Support against default risk is performed using credit tranching, which is one of the forms of security credit protection. In the simplest case, credit tranching means that any credit losses will be absorbed by the most junior class of bond holders until the principal value of their investment reaches zero. If this occurs, the next class of bonds absorb credit losses, and so forth, until finally the senior bonds begin to experience losses. The subordinated (junior) securities are typically labeled with letter B, mezzanine securities are labeled with letter M, and senior securities are labeled with letter A. Additional credit protection can be added between senior securities and in some cases between different classes of securities.

In general the structure of credit protection is a combination of two rules:

- Hierarchical structure, which specifies subordination between CMO securities with respect to allocation of recognized losses from the defaults on underlying mortgage loans.

- Pro-rata structure, which assumes equal hierarchical order of the securities and allocates recognized losses to different securities proportionally to the securities outstanding balances.

In a typical CMO deal structure, the hierarchical loss allocation structure is specified by the junior - mezzanine - senior (B-M-A) subordination structure of securities and within the securities labeled with the same letter the losses are allocated on pro-rata basis.

Principal Allocation Rules

If a security is priced at premium on the issue date, then the coupon rate on the security exceeds the security yield rate equal to the sum of risk free rate and security risk premium. In the case of early prepayment investor may incur losses on the security since investor does not receive the coupon payments, which were expected when the security price premium was estimated. Therefore early prepayment may represent a risk to the investor who expects to receive the return to the investment in the form of coupon payments over an extended period of time.

The principal allocation rules are specified for the CMO deal so that to produce securities with different effective maturity term and amortization schedule. Investor who requires protection against early principal prepayment can purchase then the securities in the CMO deal that have an effective maturity term and amortization schedule that satisfies the investor's needs.

In general, the principal allocation rules can be quite complex (and typically are more complex than the loss allocation rules). Most principal allocation structures can be viewed as a combination of hierarchical structure, pro-rata structure, and weight-based structure. The hierarchical and pro-rata structures were described above. In the weight-based structure, the principal is allocated to different securities based on specific weights that do not depend on the securities outstanding balances. For example, 20% of all repaid principal amount in a given period is allocated to security A1 and the remaining 80% of repaid principal amount is allocated to other senior tranches on pro-rata basis.

Many CMO deals specify a "crossover" date or "senior credit support depletion" date, which is defined as the date when the balances of all junior and mezzanine securities are reduced to zero. The principal allocation rule for these CMO deals typically switches from original complex rules to a simple pro-rata allocation rule, which applies to all remaining senior securities in the deal. We call the pro-rata rule a "simple" rule since it allows to analyze each senior security independently from all other securities in the deal. The principal prepayment rate, which was estimated for the whole deal based on total deal securities balances and total prepaid balances in each period, applies to each individual security if the prepaid principal is allocated on pro-rata basis.

Modeling Losses and Principal Allocation Rules

Currently the loss allocation and principal allocation rules are modeled in Alexa's CMO valuation application independently from each other. This generally imposes a strong restriction on modeled structures CMO as, for example, it does not allow to model the CMO deals with senior credit support depletion date in which the principal allocation rules depend on the total losses and respectively total balances of junior and mezzanine balances. The valuation for these CMO deals can be performed only after the senior credit support depletion date, when the principal allocation rule switched to the pro-rata rule.

Alexa's CMO valuation application is also generally not applicable to the CMO deals with multiple security classes, in which the loss and principal allocation in some security classes depend on the allocation in other security classes. The Alexa's CMO valuation application assumes a single loss and principal repayment rate that is applicable to the modeled CMO deal, while multiple security classes with cross-class allocation rules dependence require to model the loss and principal repayment rate for each security class individually.

The loss (principal) allocation rule in Alexa's CMO valuation application is modeled as a combination of hierarchical, pro-rata, and weight-based structures. The securities in the CMO deal are grouped together depending on which of the three structures is applied to each specific group. The structure is generally modeled as a tree of security groups. Each group can contain either a security or another group of securities. The allocation rule within each group can be different and is specified by one of the above three rules.

To illustrate the modeling approach, suppose that we need to model a simple loss allocation structure in which the losses are allocated based on the subordination structure of the securities. The total group of securities, labeled as G, is divided into three groups: group B of junior securities, group M of mezzanine securities, and group A of senior securities. Within each group B, M, and A the losses are allocated on pro-rata basis. Within group G the losses are allocated using hierarchal structure: first to B, then to M, and finally to A.

Describing Losses and Principal Allocation Rules

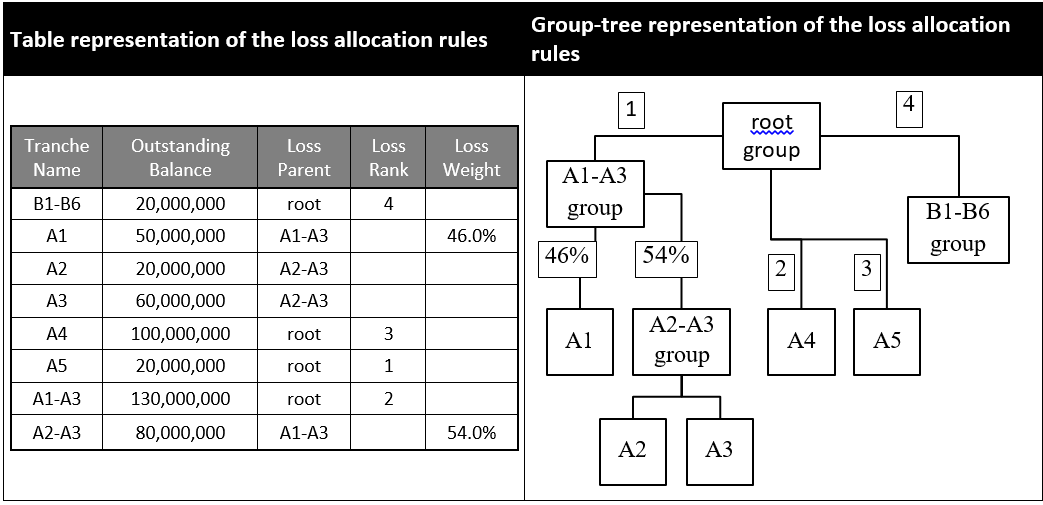

The allocation rules are described in Alexa's CMO valuation application using a table that lists all the groups and securities in the CMO deal, the group tree structure, and the allocation rule within each group. An illustration of the table and related group tree are shown in the exhibit below.

The table lists all securities and security groups in the first column (the column includes the list of all groups used to describe the allocation structure. In the example, there are three groups used to describe the structure: B1-B6, A1-A3, and A2-A3). The second column specifies respectively each security or security group balance. The third column specifies the parent group of each respective security or security group. Root is the name for the ultimate parent group that contains all securities in the deal. The fourth column describes the hierarchical ranking within the group and the last column describes the weight-based structure within the group. If a specific security or security group in the first column is assigned neither the rank in column four nor the weight in column five, then it is assumed that pro-rata structure is applied to the security (or security group).

The structure can be applied to describe generic loss and principal allocation structures. The application also performs validation of the structure. After the simulation of loss and principal cash flow allocation to each security and each security group, the application performs the following two validation tests:

- The application tests that each parent group is balanced in each period: the parent group balance equals to the sum of its child group balances;

- The application tests that allocation across the children of each parent group is consistent with the allocation rule assigned to the parent group.

Hedging CMO Securities with CDS Contracts

The credit default swap provides an additional credit support structure for a given CMO security. The support is structured as follows. The senior security ("A") is divided into three tranches: junior ("A.J"), mezzanine ("A.M" or "A.CDS"), and senior ("A.S"). The balance of the A.J tranche is typically selected to match the price discount at which security A was acquired. From accounting perspective, the losses in the A.J tranche are covered by the security A price discount (since the total value of the security is recorded in the balance sheet at the purchase price and not at the nominal value). The losses in the A.CDS tranche are covered by the CDS contract. The purpose of the A.J and A.CDS tranches is to provide additional credit support for the A.S tranche. All losses in A securities are first accumulated in A.J and then in A.CDS tranches. The sizes of the A.J and A.M sub-tranches are determined using "attachment point" and "detachment point". For example, if attachment point equals 5% and detachment point equals 15%, then the size of the A.J tranche is equal to 5% of the A security size and size of the A.M tranche is equal to 10% (10% = 15% - 5%) of the A security.

The order of principal payments is specified by the master agreement that provides the terms of the CDS instruments. A standard assumption is that the tranche A.S is repaid first, then, after the tranche A.S balance is reduced to zero, tranche A.CDS is repaid. Tranche A.J is repaid last.

The price of the CDS instrument depends on the distribution of losses in the A.CDS sub-tranche of the A security. The key parameters that affect the distribution of losses in the A.M tranche are the following.

- The outstanding balances and attachment and detachment points of security A;

- Loss and principal allocation structure of the CMO deal (which determines the loss and principal allocation to the A security);

- Parameters of loss and principal repayment distributions estimated for the total pool of underlying mortgage loans;

Each CDS contract can be equivalently interpreted as an insurance policy underwritten on the CMO security. The attachment point is interpreted as the insurance deductible and the detachment point is interpreted as the insurance maximum limit.

Alternatively, the CDS contract can be interpreted as a portfolio of long call option with strike equal to attachment point and short call option with a strike equal to detachment point, which is underwritten for the CMO security (the portfolio is also known as a bear spread).

CDS Contract Valuation

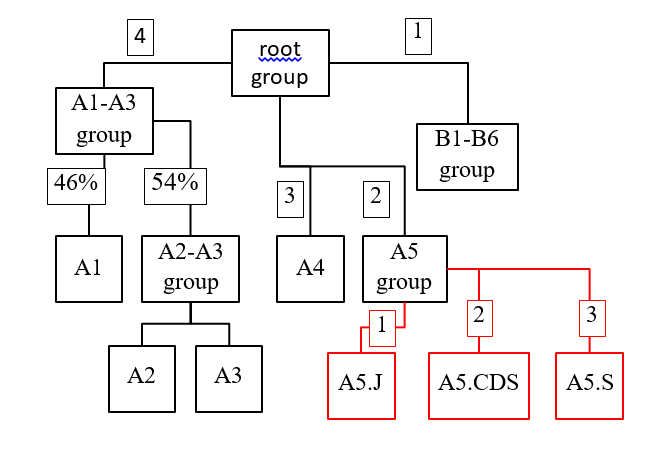

CDS contract can be modelled as follows. First the tranching of the security is incorporated as a part of the CMO deal structure. For example, suppose that security A5 in the example above was tranched into junior, CDS and senior sub-loans. Then the modified CMO deal structure would be represented using the following tree.

The modelled allocation of losses and principal and interest payments includes now securities (tranches) A5.J, A5.CDS, and A5.S. Note that by definition

NPV L + NPV Irf + NPV P = Par

(The net present value of the security losses L, principal payments P and risk free interest payments Irf equal to par value, which is by definition equal to the security nominal amount and accrued interest). The value of the security V is equal to

NPV C + NPV P = V

where C is security coupon payments. Therefore,

NPV L - NPV (C-Irf) = Par - V

where C - Irf can be interpreted as the risk spread paid on the security. Based on the above equation, if the CDS contract compensates all losses in the CDS tranche and receives the risk spread on the CDS tranche as a periodic payment, then the fixed price of the CDS contract is equal to the difference in par value and the contract price estimated using NPV valuation approach (this is the equation used by JP Morgan Chase for CDS contract valuation).

In practice the periodic payment on a CDS contract CCDS may be equal to zero, risk spread, coupon rate, or other selected value. A general equation for the CDS price based on NPV valuation is

VCDS = NPV L - NPV CCDS

Cash Flow Model

The cash flows are estimated using the following sequence of calculations in the CMO valuation application (the cash fluctuations in the application are consistent with the cash flow data analyzed for different actual CMO deals).

- Set beginning of period t+1 security balances equal to the end of period t security balances;

- Calculate the coupon payments based on the beginning of period security balances;

- Calculate losses in the balances assuming constant loss rate (estimated based on historical loss data). Adjust balances for the default losses;

- Calculate mandatory amortization for the outstanding balances. Adjust balances for mandatory amortization;

- Calculate voluntary prepayment of the outstanding balances. Adjust balances for voluntary prepayment. The adjusted balances are end of period t+1 balances.

The formulas for the cash flow estimation and estimation of the model parameters are provided in the pdf (docx) notes.

Summary of CMO Valuation Model

CMO securities valuation is performed by following the steps below.

- Based on CMO prospectus, estimate the security structure:

- Summarize the list of securities in the CMO deal;

- Summarize the outstanding balances of the securities;

- Summarize the coupon payment on the securities;

- Summarize loss allocation rules and construct the respective security group tree and related application input table;

- Summarize principal allocation rules and construct the respective security group tree and related application input table;

- Download security-specific data on losses, principal payments, outstanding balances, and coupon payments. Validate consistency of the historical data against the allocation rules summarized above;

- Download available market prices for the traded securities in the CMO deal;

- Estimate mandatory principal amortization for the total balances of the CMO deal;

- Estimate the historical loss rate based on either (i) historical loss rate data or on (ii) security market prices;

- Estimate the historical voluntary principal prepayment rate based on historical voluntary prepayment rate data;

- Estimate the cash flows in each security of the CMO deal based on the estimated parameters and formulas described above;

- Estimate the risk-free discount rates applicable to the CMO securities.

- Estimate risk-free yield term structure (based for example on Treasury rates);

- Convert the yield curves into the related risk-free discount factors Dt*.

- Deterministic approach. Estimate the price of each security as the NPV of the related security cash flows. For the CDS contracts that hedge the CMO securities, estimate the NPV of losses in CDS-covered tranches and NPV of the fixed periodic payments to the CDS seller. Estimate the CDS price as the difference between the two NPV values;

- Monte-Carlo simulation approach.

- Construct samples of loss rate and principal prepayment rate based on the estimated distributions of the loss rate and principal prepayment rate. If the loss rate is estimated based on the market prices of the securities, then construct the sample of principal prepayment rates only;

- Construct the sample of security prices (CDS prices) for each given loss rate and principal prepayment rate as described in step 9.

- Estimate the price of each security in the CMO deal as the average of the sample security prices.

Note that the Monte-Carlo approach takes into account not only the average loss and principal prepayment rate in the security valuation, but also variation in the rates. Therefore the Monte-Carlo approach is generally more accurate and more robust for security price valuation purposes.