| Author: | Konstantin Rybakov |

| Publication Date: | First publication date: March 2018 Last update: March 2018 |

| Notes: | pdf:

interest_rate_models.pdf docx: interest_rate_models.docx |

| Excel tools: | Excel tool (demo version):

srm-demo.xlsm pdf screen (demo version): srm-demo.pdf Excel tool (Hull-White version): srm-HW.xlsm pdf screen (Hull-WHite version): srm-HW.pdf |

| Objective: | The tool performs valuation of interest rate options: loan prepayment (call) and pay-on-demand (put) options using a generic interest rate model including Hull-White (extended Vasicek) and Hull-White (extended CIR) models. The tool is similar to Hull-White DerivaGem option valuation tool. |

1. Demo version: the tool includes maximum output tables but the model has a small number of states and periods (so that multiple tables can be displayed on a single tab).

2. Hull-White model: the tool includes all major tabs of a full-version tool (such as opion tree values and option tree exercise / non-exercise action), which is calculated for a collection of models that can be patioally calculated. Specifically, the parameters of the model are estimated from historical yield inputs (short-term historical yield series and current yield term structure), discount rates are estimated more precisely based on the specific model, and the model results are validated against the theoretical values (that can be calculated for the model).

3. General version: general version includes all major standard tab and assumes that short-rate model (and related discount rates) are set directly by the user. As a result, the tool does not have the parameter estimation tab (the parameters must be estimated by the user) and the tab with validation against the theoretical values.

4. Short version: the short version contains minimum output information constrained to a single tab with option input parameters and output fucntion. The purpose of the short-version is to demonstrate how the option valuation functon can be incorporated as part of other models calculations.

References:

1. "Options, Futures & Other Derivatives", John Hull, Fifth Edition, Prentice Hall, Pearson Education International;

2. "One-Factor Interest Rate Models: Analytic Solutions and Approximations", Yeliz Yolcu, January 2005, A thesis submitted to the graduate school of applied mathematics of the Middle East Technical University; pdf link at researchgate.net

3. "The General Hull-White Model and Super Calibration", John Hull and Alan White, August 2000, Joseph L. Rotman School of Management University of Toronto, link to paper on www-2.rotman.utoronto.ca

The application is similar to Hull's DerivaGem application ( http://www-2.rotman.utoronto.ca/~hull/software/index.html. DerivaGem is available only with the purchase of the Hull's textbook "Options, Futures and Other Derivatives"). The application available in this project is more flexible as it allows to estimate prepayment (call) or pay-on-demand (put) option for a generic interest rate process (Hull's tool is applicable only to Hull-White, extended Vasicek and Hull-White, extended CIR interest rate models).

A voluntary prepayment option provision (a call option) allowing the borrower to make principal prepayments in total or in part over the loan's maturity term. If market interest rates move down, then the borrower has an incentive to refinance the loan at a lower rate. Therefore the prepayment option represents a benefit to the borrower, but a risk and an opportunity cost to the lender. As a result, the interest rate on the loan with the prepayment option must adjusted up for a call option premium.

Similarly, a pay-on-demand option provision (a put option) gives the right to the lender to demand the repayment of the loan principal and accrued interest. If market interest rates move up, then the lender has an incentive to demand the loan repayment and reinvest the proceeds in a new loan at a higher market rate. Therefore the pay-on-demand option represents a benefit to the lender, but a risk and an opportunity cost to the borrower. As a result, the interest rates of the loan must be adjusted down for a put option discount.

The value of the call (put) option is estimated as the difference between the loan fair-market value (FMV) with and without the option provision. To perform the FMV valuation, a model of stochastic market discount rates must be specified. Based on the selected model of discount rates, the borrower (lender) selects in each state of the process whether to exercise the option or not. To make the decision whether to exercise the option or not, the borrower (lender) solves backward the loan FMV valuation problem. In each state the borrower (lender) compares the expected loan cost (value) if it is held for one more period and the loan cost (value) if the option to prepay (demand repayment) is exercised in the current period.

The steps of the interest rate option valuation problem can generally be summarized as follows:

- Select the model of stochastic market discount rates. Note that based on the selected discount rate process, the prices of zero-coupon bonds with different maturities and respective term structure of zero-coupon bond yield rates (zero curve) can be estimated.

- Estimate the parameters of the selected discount rate process. Parameters are generally estimated based on both discount rate historical data and market term structure (zero curve) of interest rates.

- Construct a discrete tree for the selected process. Typically a trinomial tree (with the market discounts moving up, down, or staying the same) is constructed. Alternatively a tree with a given large states (typically we select 30 to 50 states) in each period is constructed. The second option produces a larger tree but also more robust results. Note also that the maximum number of states (typically 30 to 50) is also set in a trinomial tree. The numbr of sttaes in the tree typically grows very quickly to the maximum number states and then is constrained to stay fixed.

- Perform the loan FMV valuation undre (i) no option scenario and (ii) in the presence of the call / put option. Calculate the call / put option price as the difference between the two FMV values. The call / put price is converted then to call / put annual premium / discount. Note that call / put option represents a sunk cost at the ffective date of the loan. Therefore, technically the annual premium / discount shall continue to be paid until the loan maturity regardless of whether the option was exercised and the loan repaid early. Therefore formally the loan FMV value should be adjusted for the call / put option at the loan effective date. That is the loan shall be traded at premium / discount on the effective date in the presence of the call / put option provision.

A collection of stochastic (affine) discount rate models, studied in the literature, is described in more detail in these notes (pdf) (and it MS Word version notes (docx)). Affine models are popular in the literature because they allow to derive explicit formulas for zero curve and therefore allow to derive explicit formulas for discount rate model parameter estimates.

A popular tool used for interest rate options valuation is DerivaGem, which is based on the Hull-White "Options, Futures and Other Derivatives" textbook. The tool allows to perform interest rate option valuation for two types of affine discount rate processes: (i) Hull-White (extended Vasicek) and (ii) Hull-White (extended CIR) process. In the example below, we describe the steps required to perform interest rate option valuation using DerivaGem tool. Then we compare the results of interest rate option valuation with the results generated by Alexa's application.

Problem. Suppose that the prepayment (call) option is evaluated for the 5-year BB-rated loan. Suppose also that the loan has no other option provisions (such as mandatory amortization or voluntary interest deferral) and exercising the call option is penalty free (the borrower repays only the outstanding principal and accrued interest amounts). Note that in practice prepayment and pay-on-demand options always have some penalty structure.

Data Inputs. To perform interest rate option valuation, you will need the following data:

- Terms of the loan, which prepayment option is evaluated. The term include currency, effective date, maturity date, interest payment terms (interest payment frequency and day count basis).

- Historical sample of BB-rated 3-month yield rates that represent the historical values of the market discount rate process. The currency of the yield rates must match the currency of the loan.

- The term structure of the BB-rated yield rates as of the interest rate option valuation date. The term structure includes the yield rates for the maturity term ranging from 3-month to 5-year. The 3-month term for the short-term yield rate is selected to match the default 3-month step of the tree constructed to model the discounnt rate process. Note that technically the term structure shall be converted to zero curve. However the term structure is a sufficiently good approximation of the respective zero curve.

Valuation. Valuation of the interest rate option is performed as follows.

- Select the model of market discount rates. Note that Alexa's tool is more flexible compared to DerivaGem with respect to the discount rate model that can be selected. In this example, we assume that the interest rate option is evaluated using Hull-White (extended Vasicek) model with constant drift and volatility parameters and zero mean-reversion parameter.

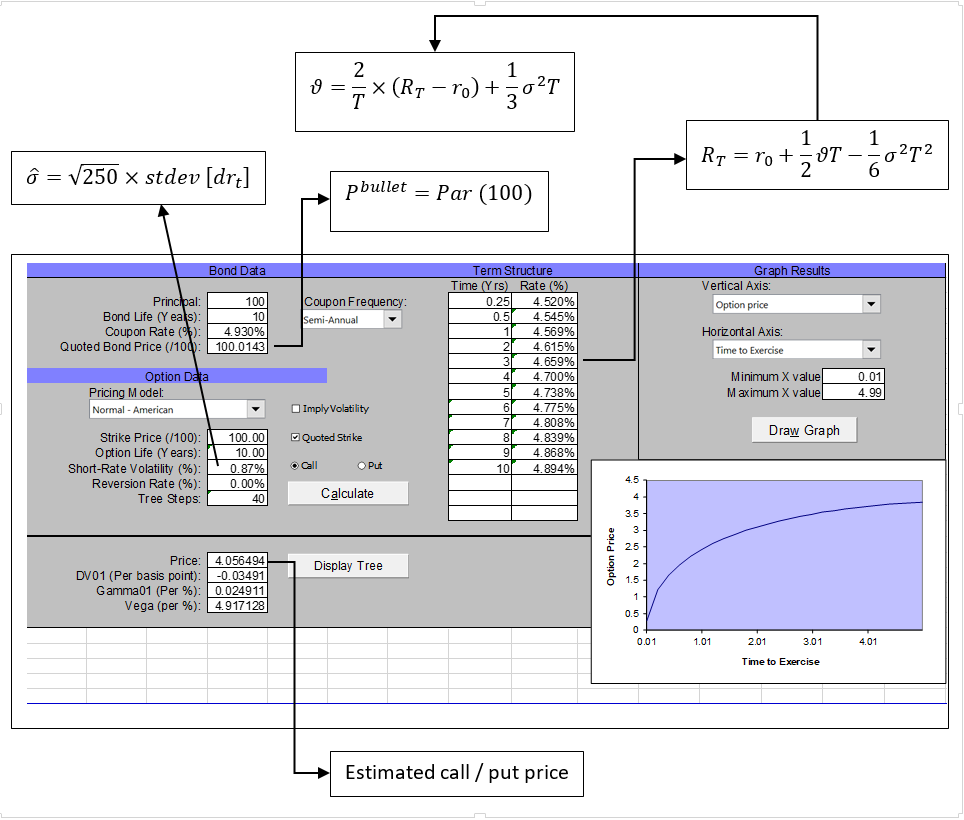

- Estimate parameters of the discount rate process. The constant drift parameter is estimated based on the shape of the yield rate term structure. The constant volatility parameter is estimated based on the historical sample of 3-month yield rates. The formulas applied to estimate the model parameters are presented in the DirivaGem screenshot below.

- Set parameters of the interest rate option model as shown in the DerivaGem screenshot below, including both (i) the parameters of the underlying loan and (ii) estimated parameters of the discount rate process.

- Solve implicitly for the 3-month yield rate so the the bullet loan is valued at

par. This step is necessary to insure that the loan coupon rate is consistent

with the market term structure and that the bullet loan is valued at par. The

callable loan FMV value is compared then to the bullet loan par value. Note that

if the bullet loan FMV value is different from par, it is possible that the

loan becomes callable directly at the loan issue date and the call option value

will not be meaningful.

As an alternative to solving implicitly for the 3-month yield rate, you can also (i) solve for implicit coupon rate or (ii) shift the whole term structure of yield rates to ensure that the bullet loan is valued at par. The difference in the results under different par-adjustment options is not material. Alexa tool shifts the whole term structure of yield rates (and respectively the states of the discount rate process) to adjust the bullet loan FMV value to par value). - Estimate the option value.

The results of each step estimation are presented in the DerivaGem screenshot below. The illustrative screenshot shows how to set the DerivaGem parameters for the Hull-White (extended Vasicek) model with constant drift (θ) and volatility (σ) parameters and zero mean-reversion parameter (μ=0). The parameters can be extended for a general term structure data.

The DerivaGem results are also compared to the results produced by Alexa interest rate option valuation tool.